Average Salary For Doctors In Australia

Salaries In Australia

It is a fairly well publicised fact that in Australia you will generally find a work-life balance better than almost any other country in the world. Your working week is based around a standard 38 hours, and you will generally find that (based on department setup) you have a lot of control over just how much after hours and on call work you want to take on.

When you take a medical job in Australia or New Zealand, you will be contracted directly by the facility you work for. At no stage will you be an employee of IMR (nor will we adjust your wages in any way, shape or form) and this means you will be paid the same rate as your Australasian colleagues – just another way that we make sure you get the best benefits you can from working with IMR.

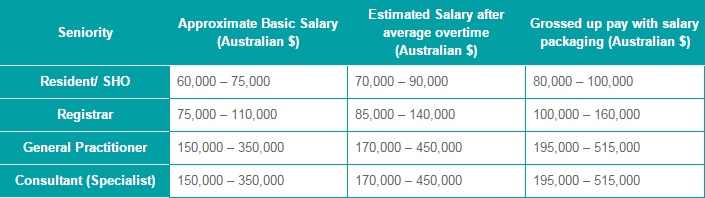

Salaries in Australia can vary slightly from state to state, but each state’s government regulates all doctors’ salaries. These are all approximate figures for basic salaries in Australia – note that after overtime and on call work these salaries will be approximately 15-25% higher, and then you can factor in ‘salary packaging’.

As we mentioned earlier, your basic salary assumes a working week of 38 hours – anything after this will be paid at penalty rates (usually double-pay). So, in reality you have a fair amount of control over how much you earn based on exactly how many work hours you are willing to do. Most facilities will have some degree of flexibility when it comes to additional hours.

Tax Rates In Australia

All public hospital employees have the opportunity to access up to 30% of their income as tax free through an initiative known as salary packaging. For current tax rates please visit the Australian Taxation Office’s website by clicking here

Salary Packaging

Salary packaging is a tax-minimisation system allowing all hospital employees in Australia to receive some of their salary tax free. This is often up to 30% of their gross wage. The basis of this is that hospital employees are exempt from ‘Fringe Benefits Tax’. This is normally a tax on all rewards given to employees which do not form the cash component of their salary. Due to this special exemption for public hospital employees, there is the opportunity to ‘sacrifice’ some of your salary and receive it as fringe benefits, which is free from all forms of tax (including income tax).

The way this works in practice is that you designate a proportion of your income (up to a maximum of 30% of total salary in many hospitals) that is to be set aside for expenses. These can include things like your household mortgage or rent, petrol expenses, household utility bills, computers, holiday travel, all the way up to eating out at restaurants. On showing the receipts for these items, you can receive your income to the value of these receipts free of tax.

Most doctors try to package the maximum amount and so receive a significant proportion of their income tax free resulting in reducing their taxable income substantially. Before commencing work, you should contact your hospital and ask for further details about salary packaging as it can save you a lot of money.

Other Benefits

In addition to salary packaging, most hospitals will give all doctors working in Australia the following benefits:

Sick Leave – up to 10 paid days per year

Annual Leave – up to 5 weeks paid leave per year

Superannuation (pension) – all doctors working in Australia receive superannuation payments to the value of at least 9% of their salary (this is paid in addition to your salary and is not deducted from it). All doctors who work temporarily in Australia may cash their superannuation earned when they leave to return to their home country.

Many hospitals will also provide subsidised meals, free or cheap accommodation and other perks

Please contact us if you would like further information about your potential salary in Australia.

Leave a Reply